ESG risks are becoming increasingly important for organizations in the Philippines, but embedding them into the ERM framework can be a challenge. Why? This is mainly because ESG risks (Environmental, Social, and Governance) can pose a threat to a company’s long-term sustainability. So, how can organizations prioritize ESG risks in their ERM? First, establish the company’s ESG risk tolerance. Then, integrate ESG considerations throughout the entire risk assessment process.

The key is to treat them as any other risk and assess their likelihood, impact and magnitude. By prioritizing ESG risks within the ERM framework, businesses can safeguard their future and create long-term sustainability. It’s an opportunity to do right by the environment and the communities we serve.

Understanding ESG risks: paving the path to sustainable growth

Companies worldwide are increasingly recognizing the importance of environmental, social, and governance (ESG) factors in driving sustainable growth. Understanding ESG risks can help businesses identify opportunities for innovation and improvement, leading to long-term success.

Image content : 79% of investors say the way a company manages ESG risks and opportunities is an important factor in their investment decision making – PwC survey 2022

ESG risks encompass a wide range of operational criteria that go beyond the traditional scope of business and financial risks. By addressing ESG risks, organizations can develop a business model that effectively manages various environmental, social, and governance challenges. Let’s take a closer look at each domain:

Environmental risks

These risks involve factors such as climate change, greenhouse gas emissions, water and air pollution, waste management, deforestation, and the organization’s impact on biodiversity..

Social risks

Social risks encompass aspects such as diversity, equity, and inclusion (DE&I), labor relations, employee health and safety, working conditions, human rights, and social justice.

Governance risks

Governance risks revolve around leadership, internal controls, ethical practices, and the organization’s overall management structure. Factors such as board diversity, executive pay, operational policies, and standards, compliance with regulations, and transparency in decision-making contribute to effective governance.

Integrating ESG risks into the ERM framework allows for a comprehensive approach to risk management, ensuring that these risks are considered alongside traditional business risks. In the following sections, we will delve into the specific challenges organizations may face when embedding ESG risks into their ERM framework, and explore actionable strategies for effective ESG risk management.

Importance of ERM and embedding ESG risks into ERM framework

Now that we have a solid understanding of ESG risks and their domains, let’s explore the significance of integrating these risks into the Enterprise Risk Management (ERM) framework. ERM provides a structured and systematic framework for organizations to identify and address risks comprehensively. Traditionally, ERM has focused on financial, operational, and compliance risks. However, as the importance of ESG factors continues to grow, it has become clear that these risks also need to be considered in the broader risk management strategy.

Integrating ESG risks into the ERM framework is essential for several reasons.

1. Firstly, it enables organizations to have a more complete view of their risk landscape. By considering ESG risks alongside traditional risks, companies can better understand the potential impacts and interconnections between various risks.

2. Secondly, by recognizing the significance of ESG risks, companies can align their risk management practices with their broader environmental and social goals. This alignment not only enhances the organization’s reputation and stakeholder relationships but also contributes to long-term value creation.

3. Moreover, combining ESG risks with traditional risk management practices helps organizations identify emerging risks and anticipate potential disruptions.

In the next section, we will delve into the specific challenges that organizations in the Philippines may face when embedding ESG risks into their ERM framework. By understanding and addressing these challenges, companies can effectively navigate the path to integrating ESG risks and promoting sustainable growth.

What are some challenges that organizations in the Philippines may face when embedding ESG risks into their ERM framework?

Organizations in the Philippines may face several challenges when embedding ESG risks into their ERM framework. These challenges include:

Pervasive nature of ESG risks:

ESG risks are pervasive risks that extend into many existing risk classes, which can make it challenging to integrate them holistically into the risk management framework.

Lack of communication between risk management and ESG functions:

One of the biggest barriers to ERM-ESG alignment is a lack of communication between risk management and ESG functions. The ESG team doesn’t always speak the same language as the risk team, and risk professionals aren’t often trained to understand, analyze, and respond to ESG risks.

Difficulty in understanding and quantifying ESG risks:

Many companies have talked about the difficulties of understanding and quantifying ESG risks. These challenges can’t be solved in silos, and ESG and ERM teams must work together toward setting risk evaluation.

Adapting stakeholder management and spreading ESG knowledge in-house:

Adapting stakeholder management and spreading ESG knowledge in-house is a significant challenge for organizations worldwide. This may require additional resources and training to ensure that all stakeholders are aware of the importance of ESG risks and how they can be managed.

Collecting, managing, and using ESG data for risk modeling:

Collecting, managing, and using ESG data for risk modeling can be a challenge for organizations that do not have the necessary expertise or resources to do so effectively.

Establishing a high-quality internal ESG risk management system:

Establishing a high-quality internal ESG risk management system requires new types of expertise, additional information channels, better analytical tools, and novel internal policies and practices that are specifically tailored to assessing the company’s ESG risks.

To address these challenges, organizations can consider leveraging an ERM framework to assess their current ESG risk. They can also prioritize and rank ESG risks, coordinate all responsible parties, and work to ensure that ESG risks are appropriately managed across the business.

Identifying and assessing ESG risks: building a robust ERM framework

Now, let’s delve deeper into the process of identifying and assessing ESG risks to build a robust Enterprise Risk Management (ERM) framework. When organizations effectively identify and assess ESG risks, they can proactively develop strategies to manage and mitigate them, enhancing their overall resiliency.

For example, climate change and resource scarcity can have profound impacts on businesses. By identifying these risks, organizations can adopt sustainable practices, invest in renewable energy sources, and develop strategies to reduce emissions and waste. Not only does this mitigate potential environmental harm, but it also strengthens the organization’s ability to adapt to changing regulations and market demands.

Similarly, labor relations and diversity, equity, and inclusion, are critical considerations for organizations. By assessing these risks, companies can ensure fair and inclusive workplaces, enhance employee engagement and productivity, and foster positive relationships with their workforce.

Here are some steps that organizations can take to identify and assess ESG risks:

- Establish clear ownership: Determine who is responsible for the ESG risk assessment, treatment and monitoring processes within the organization

- Integrate ESG risks into risk survey questions: Integrate ESG risks into risk survey questions and have respondents rate these risks on likelihood, impact, and velocity

- Leverage existing ERM processes: Many companies already have an ERM program to identify, assess, and manage risks. Companies can leverage these processes to identify and manage ESG risks with confidence

- Improve communication between risk management and ESG functions: One of the biggest barriers to ERM-ESG alignment is a lack of communication between risk management and ESG functions. Organizations can work to improve communication between these functions to enable a targeted and meaningful approach to ESG risk management

- Apply new metrics for evaluating ESG risks: Organizations can apply new metrics for evaluating ESG risks and any related data

- Keep it simple: ESG risk management might be new to the organization, so it is important to keep it simple

In the next section, we will explore the concept of materiality assessment and how it can help organizations prioritize ESG risks. By understanding the importance of materiality assessment, companies can align their risk management efforts with their most significant ESG risks, thus driving more focused and impactful actions.

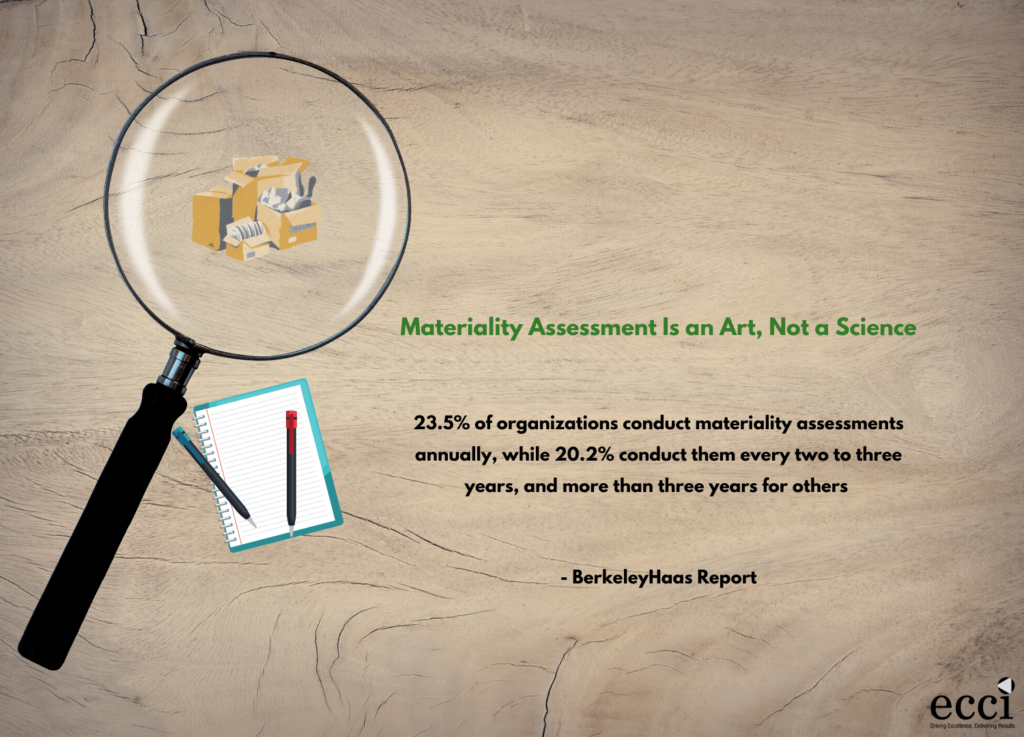

What is a materiality assessment?

A materiality assessment is a process that helps organizations determine which ESG issues are most important and consequential for their business. It involves engaging internal and external stakeholders to identify and evaluate the significance of various ESG factors based on their potential impact on the organization and importance to stakeholders.

Conducting a materiality assessment allows companies to focus their resources and efforts on managing the risks that matter most.

How a materiality assessment can help organizations prioritize ESG risks:

- Identifies ESG issues that are most important and consequential

- Engages stakeholders to gauge the significance of various ESG factors

- Focuses resources on managing the risks that matter most

- Aligns sustainability initiatives with core operations and strategic objectives

- Leverages sustainability practices for innovation, efficiency, and competitiveness

- Ensures coherence and purpose throughout the organization’s risk management

- Guides decision-making by considering risks’ potential impact and stakeholders’ interests

- Enhances long-term value creation and resilience

- Supports compliance with reporting requirements and regulatory frameworks

- Drives strategic planning and actions for positive environmental and social impacts

By integrating ESG risks into their business objectives, organizations can leverage sustainability practices as drivers of innovation, operational efficiency, and competitive advantage.

For example, a manufacturing company may conduct a materiality assessment and identify energy efficiency as a material ESG risk. By aligning this risk with their business objective of reducing costs and improving operational efficiency, the company can implement energy-saving measures and technologies. This not only helps the organization reduce its environmental impact but also contributes to achieving its financial and operational goals.

Leading companies instituting ESG risks in strategic planning

AbbVie:

As a research-driven biopharmaceutical company, AbbVie integrates ESG initiatives into sustainable growth by focusing on three foundational pillars. These pillars include creating innovative medicines to solve health problems, unlocking the potential of diverse talent, and innovating intentionally and with integrity for the long-term benefit of both patients and the business.

Activision Blizzard:

With a mission to build community and create social platforms through interactive gaming, Activision Blizzard is dedicated to ESG progress. They strategically plan to increase sustainability and equity by focusing on three areas: Protecting the Planet, Championing Our People, and Advancing More Diverse & Inclusive Communities.

American International Group (AIG):

AIG positions itself as an agent of change, navigating global challenges and ESG issues. Their ESG strategy aligns with their business strategy and is supported by four pillars: Sustainable Operations, Sustainable Investing, Community Resilience, and Financial Security. AIG aims to make a positive impact in various areas.

Allstate:

As a purpose-driven company, Allstate integrates ESG principles and practices into its business strategy. They conduct a materiality assessment to map stakeholder alignment with ESG goals. Allstate sets goals related to Climate, Responsible Investing, Human Capital Management, and Diversity, Equity, and Inclusion (DEI) to drive real-world outcomes.

Altria Group:

Altria Group is focused on responsibly leading the transition of adult smokers to a smoke-free future. Their ESG progress is guided by the most impactful issues, and they highlight six ESG responsibility focus areas: Protect the Environment, Reduce Harm of Tobacco Products, Support People and Communities, Prevent Underage Use, Drive Responsibility Through Our Value Chain, and Engage and Lead Responsibly.

Amazon:

Amazon, known for its Climate Pledge for net-zero emissions, goes beyond environmental advocacy. Their annual sustainability report highlights initiatives in renewable energy, raising starting wages, funding affordable housing, providing humanitarian aid, and diversifying representation. They prioritize social issues and governance transparency alongside environmental sustainability.

American Airlines Group:

American Airlines understands the importance of effective management of ESG issues for long-term success. Their ESG strategy focuses on topics relevant to their stakeholders, including climate change and fuel efficiency, customer satisfaction, operational performance, diversity, equity, and inclusion (DEI), safety, and labor relations. They strive for sustainability in all aspects of their operations.

Amgen:

Amgen serves patients by transforming science and biotechnology into life-saving therapies. Their ESG framework rests on four pillars: Healthy Planet, Healthy People, Healthy Society, and A Healthy Amgen. By prioritizing these areas, they ensure a holistic approach to ESG that aligns with their mission and values.

Apple:

Apple strives to provide the best user experience while serving others and protecting the planet. Their ESG practices aim to demonstrate that business can be a force for good. With a focus on people, suppliers, customers, and communities, Apple emphasizes the social dimension of ESG in its operations and initiatives.

These leading companies demonstrate a commitment to integrating ESG into their strategic planning by aligning their values, operations, and goals with sustainability.

Reporting and disclosure: enhancing transparency and stakeholder engagement

Effective reporting and disclosure play a vital role in enhancing transparency and stakeholder engagement when it comes to ESG risks. Companies that prioritize reporting and disclosure demonstrate their commitment to accountability and responsible business practices.

By publishing ESG reports and disclosing relevant information, organizations provide stakeholders with valuable insights into their sustainability efforts, progress, and future plans. This transparency builds trust and fosters meaningful engagement with stakeholders, including investors, customers, employees, and communities.

By providing meaningful and comprehensive reports, organizations can:

- Build trust and credibility with stakeholders

- Demonstrate progress towards sustainability goals

- Address challenges and risks openly

- Align business objectives with sustainable practices

- Attract socially responsible investors

- Foster engagement and dialogue with stakeholders

- Benchmark performance and learn from industry peers

- Set targets and hold themselves accountable

- Drive continuous improvement in ESG initiatives

- Contribute to a sustainable future for all

Alright, let’s connect the dots here. Materiality assessments help companies identify their key ESG risks. And when they align robust reporting with these risks, it enhances transparency, engages stakeholders, and builds trust. It’s all about putting their ESG commitment into action and sharing the progress with the world.

Mitigation strategies: turning ESG risks into opportunities

Mitigating ESG risks is crucial for organizations to thrive in today’s business landscape. By implementing effective strategies, companies can minimize their negative impact and capitalize on the potential opportunities they present. These strategies can include proactive measures, such as:

Risk avoidance:

Taking actions to completely avoid or eliminate exposure to identified ESG risks

Risk reduction:

Implementing measures to minimize the likelihood and impact of ESG risks

Risk transfer:

Shifting the responsibility for managing ESG risks to external parties, such as insurance or contractual agreements

Risk acceptance:

Acknowledging and accepting certain ESG risks while implementing measures to mitigate their potential consequences

Risk sharing:

Collaborating with stakeholders, partners, or industry peers to collectively address and manage ESG risks

To unlock the potential of ESG risks and turn them into competitive advantages, organizations can implement these five steps to get started:

1. Conduct an ESG materiality assessment

Prioritize the most important ESG topics by gathering perspectives from internal and external stakeholders. This assessment helps identify the risks that are most relevant to your organization.

2. Connect diverse ESG stakeholders through workshops

Dive deeper into each ESG topic, explore specific risks, and understand their impacts on people, stakeholders, and the environment. Engage a variety of voices from across the organization to gain a comprehensive understanding.

3. Prioritize risks based on likelihood and severity

Assess the likelihood and potential severity of the risks. Focus on mitigating risks that pose the greatest threats while identifying opportunities to become a leader in specific ESG areas.

4. Integrate top risks into ERM systems and ensure clear reporting

Incorporate the prioritized ESG risks into your enterprise risk management system. Establish appropriate reporting structures to track progress and disclose actions taken to mitigate risks.

5. Maintain agility through continuous risk updates

ESG risks are dynamic, so it’s essential to establish ongoing processes for updating and monitoring these risks. Regular touchpoints between sustainability and risk teams ensure better integration and continuous risk mitigation.

This approach not only enhances business efficiency but also builds short- and long-term value while aligning ESG and ERM strategies. By aligning these strategies with reporting and disclosure efforts, companies can enhance transparency, build stakeholder trust, and seize the opportunities that ESG risks present for sustainable growth.

The bottom line

In a world where sustainability is no longer a choice but a necessity, organizations that embrace ESG risks with open arms are the ones poised for greatness. By weaving environmental, social, and governance considerations into their DNA, they transcend mere compliance and embark on a journey of purposeful growth. They become pioneers of change, magnets for talent, and beacons of trust in an uncertain world. Remember, ESG isn’t just about ticking boxes—it’s about paving a path towards a better future, where success and sustainability go hand in hand.

If you need help transforming your company and making it more resilient, reach out to us at ECCI. Our expert team specializes in promoting organizational resilience. We provide tailored strategies and practical solutions to identify and mitigate ESG risks, develop contingency plans, and enhance your organization’s overall resilience. Don’t wait for the next crisis to hit—take proactive steps now.

Contact ECCI Consulting today and let us guide you towards a more resilient future.

To start your journey, simply get in touch with us and enjoy a free advisory session. Visit our webpage for more information on how we can help you.