Sustainable finance is transforming the way businesses grow and capital is deployed, driven by the urgent realities of climate change, rising social expectations, and digital disruption. Once a niche, it is now a strategic priority, embedding Environmental, Social, and Governance (ESG) principles into core decisions to build long-term, resilient value.

What Is Sustainable Finance?

Sustainable finance refers to the process of considering ESG factors in financial services and investment decisions. This ensures that capital is directed not just toward profit but also toward environmental sustainability, social well-being, and sound governance practices.

The European Commission defines it as

“Finance to support economic growth while reducing pressures on the environment and taking into account social and governance aspects.”

Why It Matters — Global and Regional Momentum

Sustainable finance continues to expand globally. Despite market headwinds, Bloomberg Intelligence predicts that global ESG assets could reach $40 trillion by 2030, reflecting the sustained demand for responsible investing and the growing integration of ESG principles into financial markets.

In Asia, the trend is even stronger. The Asian Development Bank (ADB) reports that in 2023, the sustainable bond market in ASEAN countries, China, Japan, and South Korea (ASEAN+3) grew by 29.3%, outpacing the growth in global and European markets. These countries reached a combined total of $798.7 billion in sustainable bonds—about 20% of the global market.

This rapid growth presents a major opportunity for the Philippines to attract more green investment, improve its ESG performance, and take a leadership role in sustainable finance across the region.

The Philippine Context

- The Bangko Sentral ng Pilipinas (BSP) is leading the integration of ESG into financial systems through its Sustainable Finance Framework, requiring banks to embed sustainability into strategy, risk management, and operations.

- Complementing this, the government has empowered the Green Force—formally the Inter-Agency Technical Working Group on Sustainable Finance (ITSF)—co-chaired by the Department of Finance (DOF) and the Climate Change Commission (CCC). Tasked with implementing the Sustainable Finance Roadmap, the ITSF expanded its mandate in 2025 to include quarterly reviews, specialized clusters (Policy, Financing, Investment), and a forthcoming Center of Excellence for Sustainable Finance.

- The Securities and Exchange Commission (SEC) of the Philippines will implement mandatory sustainability reporting for listed companies by 2026, using a phased approach to support a smooth transition. To prepare the market, the SEC will conduct a market readiness study to identify potential barriers and ensure alignment with International Financial Reporting Standards (IFRS). During the transition period, companies are still operating under the “comply or explain” framework, which remains in effect as the 2026 implementation approaches.

- Private sector engagement is also growing, with firms like Ayala Corporation and BDO Unibank issuing green and social bonds to finance renewable energy and inclusive development.

ESG in Action: Aligning Business with Consumer Expectations

An effective ESG strategy is at the core of sustainable finance, enabling businesses to manage risk, create long-term value, and respond to the increasing demands of stakeholders and the market.

This is more than a best practice; it reflects what consumers increasingly expect. Filipino consumers are among the most sustainability-conscious in Asia Pacific. According to the PwC Voice of the Consumer Survey 2024, they are willing to pay up to 13.4% more for sustainable products—the highest among surveyed markets and well above the 9.7% global average. While inflation and living costs may affect actual spending, the intent is clear. Filipino buyers value visible sustainability actions.

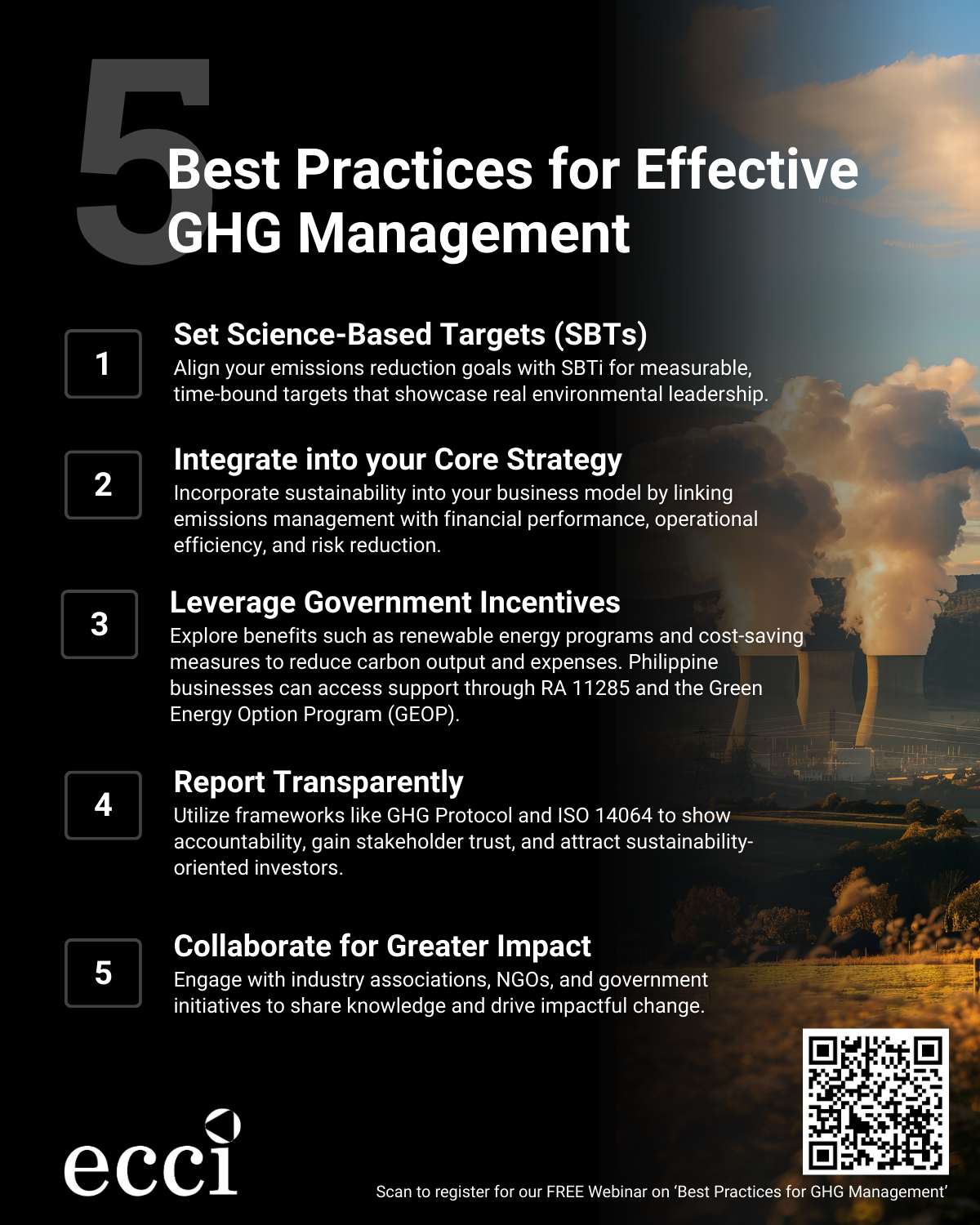

Practical Tips for Getting Started

Whether you’re in a corporate boardroom or running a growing SME, these tips can help you embed sustainable finance principles into your operations:

- Assess Your ESG Impact

Start with a baseline audit of your current environmental footprint, labor practices, and governance policies. - Set ESG-Aligned KPIs

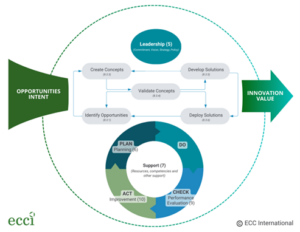

Integrate ESG into strategic plans—e.g., emission reduction goals, gender parity in leadership, or green procurement targets. - Build Capacity

Invest in training programs to equip your team with ESG knowledge and tools. - Innovate Products and Services

Develop offerings that reflect your sustainability potential, such as green financing tools, ESG-linked insurance, low-carbon products, ethical investment funds, or inclusive digital services. - Report Transparently

Use global reporting frameworks (e.g., GRI, SASB, TCFD) to communicate ESG progress with credibility. - Engage Stakeholders

Involve customers, employees, and partners in ESG initiatives. Their input adds value and accountability.

What’s at Stake?

Integrating ESG is essential—not just for business, but for the Philippines’ long-term resilience and global competitiveness. The Climate Risk Index 2025 ranks the Philippines 10th globally among countries most affected by extreme weather events from 1993 to 2022, highlighting our chronic climate vulnerability.

Climate-related disasters cost the country billions annually, threatening infrastructure, communities, and economic stability. For businesses, neglecting sustainable finance is more than a reputational risk—it can mean losing access to investors, climate funding, and global markets. As the world shifts toward low-carbon, inclusive economies, the Philippines must act decisively. Sustainable finance isn’t just a corporate strategy—it’s a national priority for securing long-term growth and economic security.

Building Capacity: The Sustainable Finance 101 Program

Join us for a free webinar on “Why Sustainable Finance 101 Matters” happening on July 17 at 2:00 PM via Zoom. This session will highlight the growing relevance of sustainable finance and how organizations can begin strengthening their internal capacity for ESG integration. Open to professionals across all industries, the webinar offers a preview of the key themes and tools featured in the Sustainable Finance 101 program. Register here: https://us02web.zoom.us/meeting/register/3C3DBloVT6C2baeV7Z45eQ

For those seeking in-depth learning, the Sustainable Finance 101 (SF 101) hybrid training course—developed by ECC International in collaboration with APEX Global Learning—is also available. Tailored for professionals in finance, strategy, risk, and sustainability, the paid program covers ESG fundamentals, BSP and SEC compliance, sustainable product innovation, and case-based application. SF 101 equips participants with the skills needed to translate ESG commitments into measurable action. Learn more and register: https://www.apexgloballearning.com/courses/sustainable-finance-sf-101/